🍿 Interest in AMC Surges; Stocks Pare Losses After Brief and Sharp Correction

Updates about $AMC, $WKHS, $SQ, $SNAP

If you flinched just a bit, you might have missed the massive intra-day moves yesterday. Stocks fell sharply in the first 30 minutes only to pare back much of the losses in the rest of the trading day. In his testimony to the Senate Banking Committee, Fed Chair Jerome Powell noted as inflation wasn’t a threat due to the pandemic and pledged to continue the Fed’s monetary easing policy. The music is on. 💃 🕺 So what are retail investors thinking? Onto today’s update:

🍿 📈 AMC Interest Picks Up as Stock Price Rallies

AMC was the most discussed stock yesterday, ahead of usual retail favorites like GME and PLTR. AMC mentions accounted for 9.5 percent of all discussions, with 452 mentions. The stock price increased 10 percent yesterday, remarkable given that most stocks were down.

The recent momentum of the stock has been fueled by the announcement that AMC could partially reopen theaters in New York City. Wedbush Analyst Michael Pachter characterized the reopening as “a ray of light” for the company.

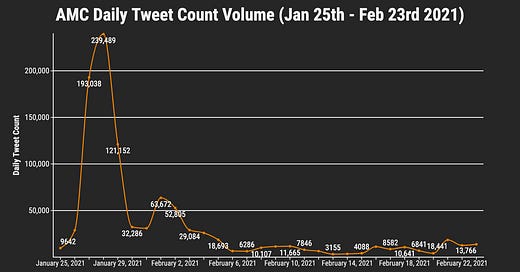

So how does this recent buzz for AMC compare to the BANG mania a month back? We looked at Twitter volume data to find answers: At its peak, there were 239k tweets about AMC on Jan 28th. After that, tweet mentions dialed down and hovered between the 5k to 10k range. Yesterday, there were 14k tweets. In short, the buzz about the stock is nowhere near its peak a month back but still higher than normal.

🚗 😕 Spotlight on WorkHorse (WKHS) After Company Fails to Win the USPS Contract

There had been considerable hype about the WKHS, an EV manufacturer, and its prospects of winning a contract with USPS. This led the stock to increase nearly 10x from $4 last year to $40 at this year’s peak. However, WKHS dropped about 50 percent yesterday after an announcement that company failed to obtain a contract from USPS. USPS awarded the contract to Oshkosh (OSK), a rival company instead,

This recent news development dashed many retail investors’ hope and put the spotlight back on the company again. WKHS mentions increased 4433 percent from 3 to 136 mentions, yesterday. WKHS was the 6th most discussed stock yesterday. Analysis of retail investor’s comments reveals that they are mostly negative on the stock and they couldn’t identify any positive catalyst to turnaround the stock.

👀 Other Things to Keep an Eye On:

Mentions of Square (SQ) increased 167 percent from 46 to 123 yesterday. SQ announced a miss on its revenue and payment volumes in its earnings announcement yesterday. The company also revealed additional Bitcoin investments.

SNAP mentions tripled yesterday from 10 to 43. Retail investment has increased after the company shared that it was in a strong position to deliver 50 percent revenue growth for the foreseeable future as it improves its ad eco-system.

--

We have a developed a program to track Twitter mentions in addition to Reddit. If you want a comprehensive analysis of social sentiment for a stock, ping us at stockhailer@gmail.com.

That’s it for the day folks. Have an awesome day ahead! Catch you all tomorrow.